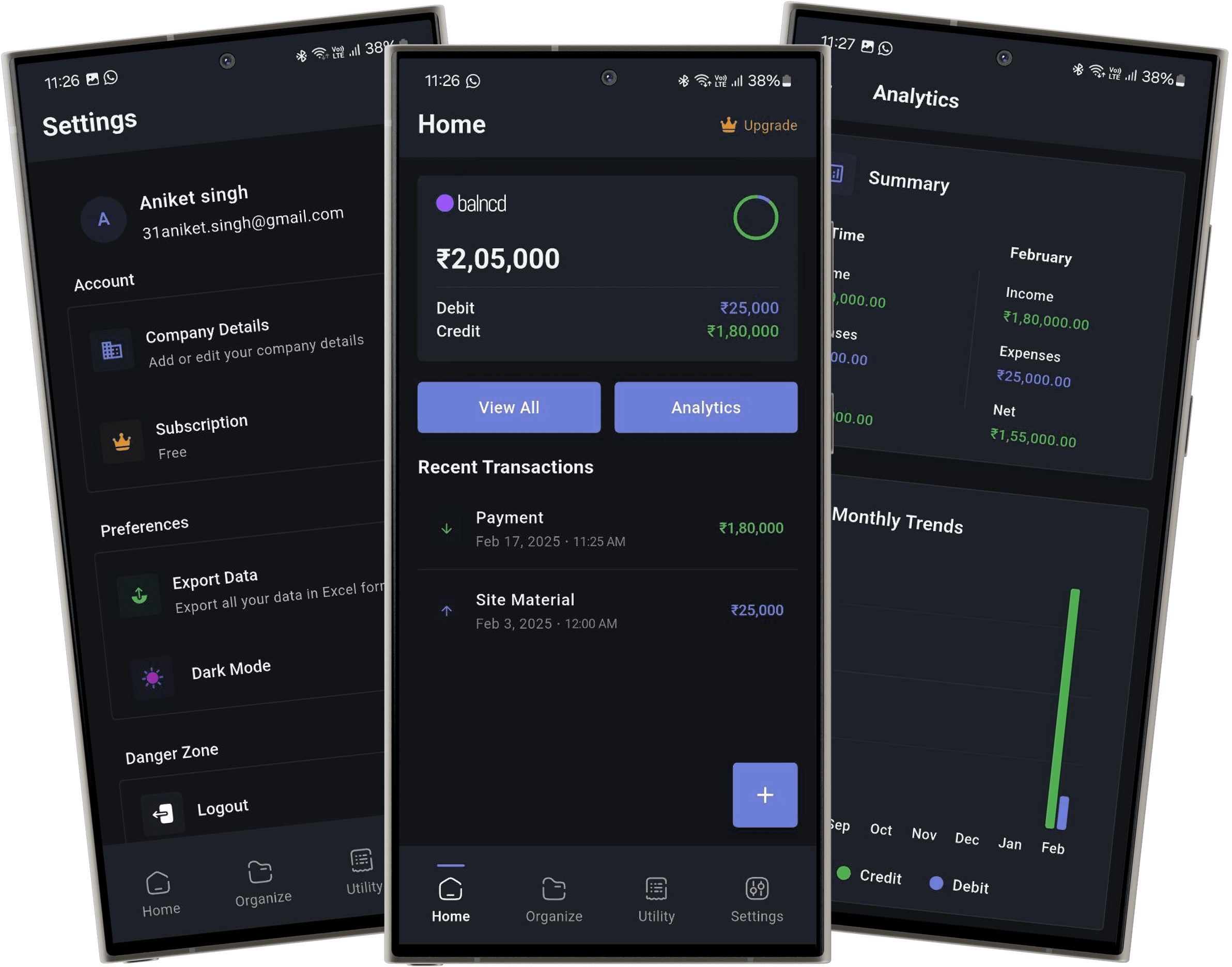

One App for All Your

Business Needs

Track transactions, create professional GST invoices, and manage documents with our beautifully designed mobile app. Works offline, syncs automatically.

Everything You Need

Streamline your business operations with our comprehensive suite of financial tools

Track Transactions

Keep track of every financial movement with our intuitive transaction management system

Create Invoices

Generate professional GST invoices instantly with customizable templates and branding options

Organize Documents

Keep your financial documents organized with smart folders and easy categorization

Export Anytime

Your data is yours to keep. Export your data anytime you want in excel formart.

Offline Access

Access and manage all features without internet. Perfect for areas with limited connectivity.

Cloud Sync

Automatically sync your data across devices when connected to ensure you never lose important information

How Balncd Works

Track Your Transactions

Start by recording all your business transactions—income from sales, expenses for operations, payments to suppliers, and receipts from customers. Balncd makes it easy to categorize each transaction, attach receipts or invoices, and add notes.

Create Professional GST Invoices

When it's time to bill your customers, Balncd helps you create professional GST invoices in seconds. Simply enter customer details, add items or services, and the app automatically calculates CGST, SGST, or IGST based on the place of supply.

Organize with Smart Folders

Keep your financial documents organized using Balncd's smart folder system. Create folders by client, project, date, category, or any system that works for your business. Group related invoices, transactions, and documents together for easy access.

Export and Analyze

Your financial data belongs to you, and Balncd ensures you can export it anytime in formats like Excel, CSV, or PDF. Export all transactions, invoices, and documents for tax preparation, accounting software integration, or custom analysis.

Why Choose Balncd for Your Business?

Perfect for Indian Businesses

Balncd is built specifically for Indian businesses, with deep integration of GST requirements. The app understands the complexities of CGST, SGST, and IGST, automatically determines the correct tax type based on place of supply, and ensures all invoices are compliant with GST regulations.

Works Offline, Syncs Automatically

Unlike many finance apps that require constant internet connectivity, Balncd works completely offline. This is especially valuable for businesses operating in areas with limited connectivity, for field work, or when traveling.

Simple Yet Powerful

Balncd strikes the perfect balance between simplicity and functionality. The app is designed to be intuitive, so you can start using it immediately without training or tutorials. Yet it includes all the features you need for comprehensive financial management.

Complete Data Ownership

Your business data is valuable, and you should have complete control over it. Balncd allows you to export all your data anytime in multiple formats—Excel for analysis, CSV for imports, or PDF for documentation.

Who Can Benefit from Balncd?

Small Business Owners

If you run a small business, shop, or retail store, Balncd helps you track daily sales, manage expenses, create invoices for customers, and maintain organized financial records.

Freelancers & Consultants

Freelancers and consultants can use Balncd to invoice clients, track project expenses, manage multiple clients, and organize documents by project.

Service Providers

Service businesses like contractors, repair services, or professional services can create GST invoices on-site, track service-related expenses, and maintain client records.

E-commerce Sellers

Online sellers can use Balncd to track sales, manage inventory-related expenses, create invoices for B2B customers, and organize financial records by product category or sales channel.